In 2016, I wrote What To Expect From The Neuromonitoring Field In The Future? right after the elections. As we find ourselves in another election year — and in what’s probably still the first inning or 2 of the COVID-19 outbreak — it seems like the perfect time to make some bold predictions. Knowing I’ll get almost everything wrong to some extent, please don’t put too much stock into any single claim. Remember, there are a lot more possible outcomes that can happen than will.

That being said, I still believe more of the same from my last post. But I won’t reiterate those points here. Instead, I’ll build off of a big lesson we need to learn, as IONM businesses and individual SNPs, coming off of the economic downturn from the pandemic. And that revolves around making a case for slack and what that might look like going forward.

Tight Coupling, Efficiency, and Slack

When we finally caught on this was a viral spread ramping out of control, one solution was to use leverage points within a network (in this case, communities across the globe). One such tactic was disrupting the connectivity of nodes (people) within the network. Distancing, as well as physical barriers like a surgical mask for all or plexiglass in front of our cashiers, acted on this lever to help flatten the virus’ growth curve.

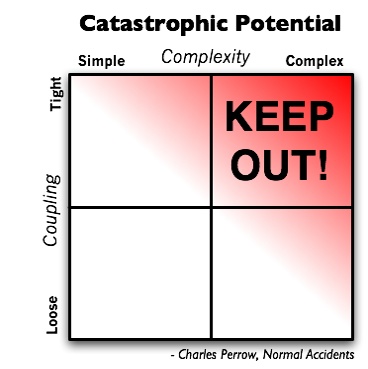

With social distancing, quarantines, and non-essential business shutdowns, we started to see chaos in those practices where tight coupling leaned towards extremes. Tight coupling is when you have one area that is closely related to others. In simple systems, these processes are predictable and can be managed. If A acts on B, then mind A’s impact on B. Here, there’s less risk and efficiency to be gained.

The effects of new problems starts with the disruption of the usual pattern with an insufficient buffer built into the system to deal with it. It’s adding Nitrous and making a bet on how your quad tcMEPs will look in 2 minutes.

This is more likely to happen in unpredictable, complex systems. COVID-19 exposed this in areas uncommonly considered. Tight coupling as a result of gaining efficiencies is the lesson going forward we need to keep a closer eye on; simply put, assessing risk in complex systems and hedging our bets.

Understanding the potential problems associated with tight coupling, we can take a look at our 2020 scorecard. If we’re talking about small businesses, some going 10 years in a strong market full of optimism, we can see how many elected to take on the risk of being highly efficient to capture as much of those tailwinds as possible. Hedging one’s bets, or making a case for slack in times where efficiency was the proven winner in recent years, is tough to make in the moment. While not many have ever insured against a 50-100% drop in revenue, it might be surprising that the companies riding a 10 year high to have only 27 days cash buffer. Where there’s been nothing but opportunity to be flush with cash, there’s also been the opportunity of returns. Again, all of this is easy to see in hindsight and the bet to go after returns might have been the right call to make in some instances.

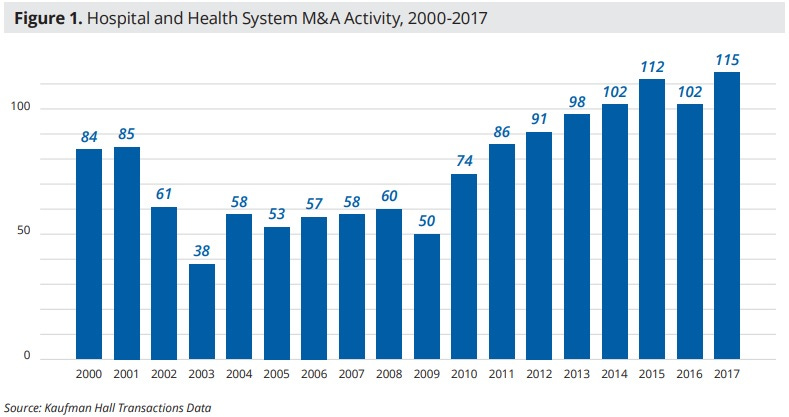

With the government bailouts and reopening of business, we’re staying afloat for the time being. Fingers crossed that we’re able to pick up the pieces and not rely on any more government intervention (we’ve already put enough financial burden on the Millenials), but it seems like we might have another round in July. We can use the above chart as a proxy for our own industry and make some guesses. But that’s not where the predictions are going to be made here. For these predictions, we’ll take a look at a step broader at the scope of the business of healthcare.

Predictions

In April, it felt like the COVID-19 outbreak was going to change everything. At the start of June, with more opinions than practical guidance, it feels like the history books will be watered down with opposing viewpoints. The lessons of COVID-19 will fade sooner than they should. They will only slow down the direction we were ultimately headed in healthcare (while speeding up other realities like remote work) and that will be reflected in the predictions below.

1. We Hit the Next Cycle of Bundling

Healthcare started as home-based care; doctors needed little more than a little black bag. Then monster systems, like John Hopkins, created a central location for healthcare providers and patients to meet. Healthcare delivered became a destination. It was a major change in not only the advance in specialized medicine, but also how care was delivered. With everything under one roof, healthcare (sick care, more accurately) was bundled. You went to the same shop to get your bunion and your blood sugar fixed. That’s been the bones of delivering modern medicine.

More current trends consist of further consolidation into large health systems. We moved in the direction of sick and health care under one roof under the control of fewer. Tightly wound in order to utilize efficiencies of scale.

And then COVID-19 hit and overwhelmed our hospital systems. The system was too tightly coupled. Patient beds full of COVID-19 patients limited capacity. There was not enough slack built into the system.

Telemedicine (today’s version of the little black bag visit) and satellite facilities (surgery centers in our world) were the available options perfectly suited to step in. This, in a sense, was a glimpse of what unbundling the healthcare system might look like. Telemedicine would reduce patient wait times and decrease doctor’s downtime. Trends towards going back to private practice might accelerate. Specialty satellite facilities, better equipped to serve a particular need, would pop up all over the place. Just-in-time delivery would handle most of the logistical problems. The hospitals would be used for procedures that require the “Big Toys,” think robotics, navigation, etc., but would no longer serve the majority of services provided.

For us as patients, this could be a blessing out of the COVID-19 tragedy. It could spark local competition instead of local monopolies.

For us as SNPs, we might find more cases in outpatient settings with physicians having more say in who is monitoring their cases. At the hospitals, we might find our more seasoned clinicians handling the higher-risk cases, or at least cases that required Bigger Toys.

At least that’s what it will feel like in 2020. 2021 will have us back in the hospitals (especially if regional hospitals find themselves in need to sell to larger systems) or ASCs getting bought up by those same systems. Moving to more satellite facilities could still make sense for health systems, but The Affordable Care Act makes it too expensive for private practice groups. We find ourselves back to the line of thinking that 1 solution can serve the patient’s care journey better than separate groups. Or some other alternative reality where insurance companies own the physician groups and look to cut out the middlemen.

But then again, we’re in an election year…

2. The Risk of Ink – Continuous Trends to Single Payer

There are a couple of different ways we get paid for our services. The bulk of it comes from third-party payers (government and insurance, for the most part). Like all other healthcare providers, we accept the risk that comes along with it. Namely, the Risk of Ink. In healthcare, all it takes is a couple of stokes of a pen to completely change what it is you get paid for what you do or sell. EEG just got inked. We had it years ago when the G0453 codes were drawn up.

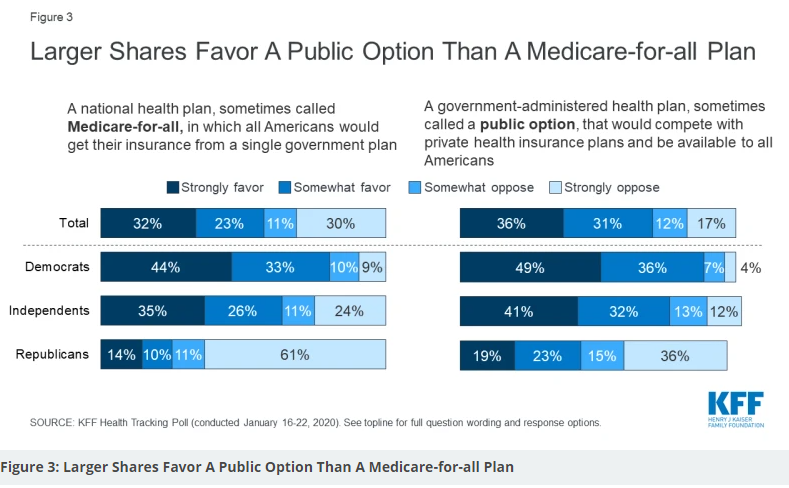

That’s more code specific risk. But there’s potential for a major overhaul. While we’ll probably never Feel the Bern, there was a surprisingly (at least to me) rally + acceptance around a single-payer system. At this point, we probably won’t see the pendulum of change swing as far as it could, unless the road to higher healthcare cost continues to march on.

I know, I know. A lot of the above depends on who gets elected. But there are some other bipartisan bills to think about, like addressing surprise billing. With all of that said, it’s the companies with less slack built-in (or those who aren’t playing the infinite game) that will have the most difficulty with change.

3. Services Over Stuff

If you want to look at a company’s survivability, one area to look is their overall ratio of capital investments to assets. Capital investments are the stuff, like Big Toys.

Big Toys are fun but they need to pull their weight. A Big Toy might not get higher reimbursement, but maybe it helps with marketing to patients as “the latest advancement,” or bring in new surgeon to fill OR time, or do something (potentially/possibly) better. While hospitals never like that O-arm in the closet collecting dust, a shutdown parks everything. It cost you the same and does none of the work.

It would have been hard to imagine how an O-arm is tied to a viral spread (people still need surgery, right?) but we saw when the complex system was too tightly coupled, it could have been parked because of multiple reasons. Supplies to perform surgery, beds available for recovery, available cash to pay staff, etc.

On the other hand, salaries and services are more adjustable. We all know the story of layoffs or furloughs, deploying staff to meet other needs (COVID testing), and not paying for services not used (like us). So when it comes to thinking about derisking your company/hospital/personal life, you might give weight to services over stuff.

How does that affect the neuromonitoring industry? The more obvious answer is the continued trend of more outsourced services (especially if we start down that path of unbundling). The risk of capital investment is passed onto the service provider.

The less easy to imagine answer is a slow down of innovation that poses a threat to the field. Biologics, robotics, AI, etc. are all tomorrow’s promised solutions, so long as there are promises to purchase. Healthcare’s regulatory speed has also been the pacesetter. Reduced interest could be off switch.

At least that’s what it will feel like in 2020. 2021 will be dripping with the same innovative buzzwords. But there’s still a lot of red tape, possibly more, to run through. Amazon, Google, and Berkshire are all betting on healthcare’s eventually being eaten by software, and I’m not so bold as to short them.

4. The Middle Get’s Muddy

If the above predictions do come to fruition, this prediction really just points out the most likely scenario. There’s a saying that goes something like “small companies are small for a reason…” That’s because it’s hard to grow. But there a lot of smaller companies are built on a handful of strong relationships and those can go a long way. A full career in some instances.

Larger companies, on the other hand, might find themselves better positioned to handle larger requests being made as consolidation continues across the country. This could be either staffing, education, accreditation, reporting, and/or adopting hospital system operational preferences.

It’s the middle spot where things might get messy. It’s not as easy to take on the large bids (the next hire is more marginally expensive), overhead has crept up from where it used to be (more people in specific roles), systems can be immature, and the founder-as-the-face branding starts to go away. In order to continue to grow to the next level, new levels of efficiencies are needed. The paradox is preparing for growth is also leaving oneself more vulnerable to the downside and that’s where things may get messy.

As the unbundling and consolidation continues to take shape, the middle finds itself in an unfriendly environment. The result is the dumbbell-shaping of our market in-step with the health systems.

Conclusion

No one can predict the future. We can barely manage it in highly volatile times. In the midst of COVID-19, an important lesson to remember is the value of a hedge. What this pandemic uncovered was the majority of small businesses not giving enough priority to downside risk possible due to the interconnectivity of complex systems. The reaction to that lesson by our customers — which will drive the direction neuromonitoring — is what shaped my predictions of unbundling, services over stuff, market consolidation with a messy middle, and preparing ahead of time for the Risk of Ink.

Feel free to agree, disagree, on come up with your own predictions in the comments section. Just play nice.